Europe’s Come-From-Behind Campaign in the Global Battery Race

2023. 09. 14.

Our continent overslept the EV revolution in terms of ramping up sufficient battery capacities. Careful planning and joint effort can help in the catch-up campaign against Asian stakeholders that had a head start early on. Excerpts from the panel discussion “Europe’s Giga Decade: Ready for Take-Off?” that took place at IAA Mobility 2023.

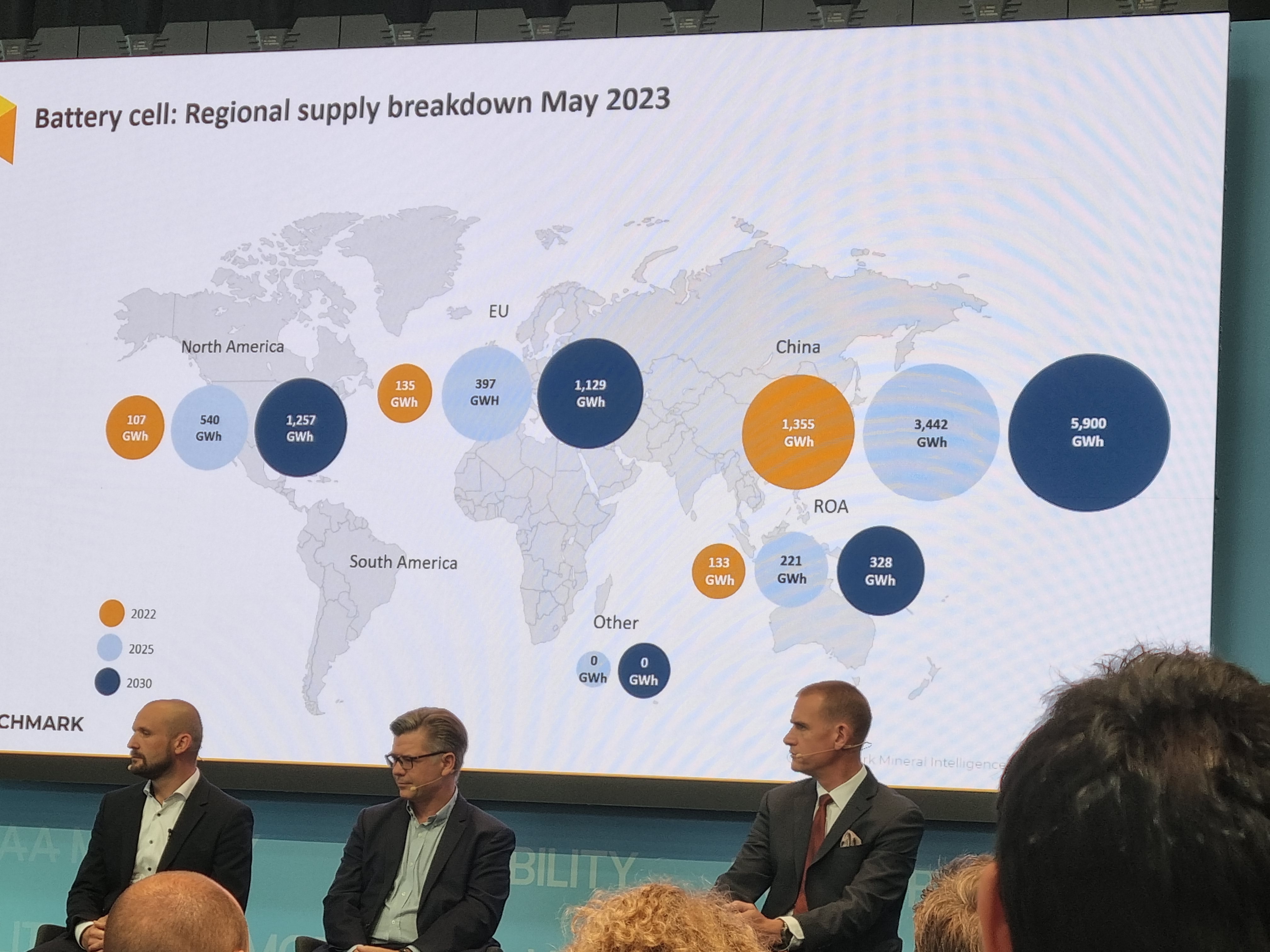

Europe is lagging behind Asia when it comes to battery manufacturing capacities. We are talking about a staggering ten-fold difference. Taking into account announced projects, the gap should close, but the East will have been in the lead significantly even by 2030 (5,900 GWh vs 1,129 GWh).

According to Michael Schmidt, geologist at DERA, we must acknowledge that Europe is never going to be self-sufficient in this field. According to him:

Most people don’t realize that it takes 5-15 years till mining projects materialize which may endanger overambitious planning.

Still, Europe’s import dependence on lithium could go down from the current close to 100% to 62-70%. Recycling is going to gain on significance only after 2030. However, it’s clear that end-of-life batteries mustn’t leave Europe, otherwise it will cause the drainage of raw materials.

The downside of cheap capital

Philippe Chain, CCO of Verkor SA emphasized that Europe wants to start a whole new battery manufacturing concept based on efficiency with the help of fully digitalized factories and standardized data flows. France’s Battery Valley is a great example that also relies on a revolutionary approach that recovers waste heat from nearby factories, and thus covers up to the half of battery production energy.

On average ROI of 8-11% can be counted on, but it can go down massively depending on commodity prices. Hopefully, by embracing the above-mentioned efficiency driven concept, profitability is going to become tech-driven rather than commodity-driven.

Evan Horetsky, chief development officer at AESC, who’s involved in building 13 gigafactories across the world, drew attention to the fact that Chinese companies had super cheap capital resources at their disposal which took a toll on efficiency and negatively impacted scrap rates. In Europe and the US where finance is a lot more expensive in spite of the EU’s Green Deal Industrial Plan and the IRA, efficiency must be the number one factor to consider.

End user awareness

Colin Mackey is MD of Rio Tinto, one of the biggest mining companies in the world, so he knows a thing or two about critical raw materials needed for making batteries. As he points out, importing, recycling more and mining more transparently are the three critical factors European members of the EV value chain must observe at all times. A transparent supply chain is also needed to make sustainability happen.

Mackey said.

According to Tom Einar Jensen, co-founder of Freyr Battery SA, when it comes to site selection in this segment, what you need is large land, cost-competitive (possibly clean) energy, talent and good infrastructure where you can get materials in and products out. Incentives are also key, though. “It all starts with political leadership, and the IRA is a poster child of that. However, finance is provided only if the value proposition is competitive.”

France launched the so-called “l’école batterie” where 1,500-1,600 people will be trained a year on how this whole industry works from low-skilled workers to engineers at the PhD level. This could be a role model for others that strive to become the champions of electrification.

Related articles

Sector articles

The opening of a new facility employing 80 people marks a new chapter for Einhell, the German producer of battery-powered DIY and garden tools. With an investment of over EUR 4.93 million, the market leader is setting up its first European manufacturing plant in...

2024. 07. 23.

Battery #BatteryOEMs that are present on the Hungarian market plan to implement their electrification strategy here, and they need strong partners to achieve that objective. This economic necessity is one of the driving forces of the dynamically growing local EV ecosystem that ...

2023. 10. 17.

Battery #BatteryThis year the most important annual meeting of local and regional battery industry stakeholders, the III. Hungarian Battery Day conference will take place on 26 October in Budapest, organised jointly by White Paper Consulting and the Hungarian Battery Association.

2023. 10. 05.

Battery #Battery